“Capitalism is Great!”, Inc.

Many socialists and Marxist criticize capitalism through the lens of materialism, critical theory and class struggle in an attempt to instate their vision of an utopian communist society.

The purposes of this article is not to parrot some idealistic theory, but to explain the relationship between capitalism, socialism and namely: how their end goals are one and the same.

The Conservative Praise of Capitalism

There seems to be a prevalent theme throughout the entirety of the conservative political establishment, the blind praise for the ideology known as capitalism.

I often hear many conservative pundits calling Google, Facebook and Twitter “communist” organizations.

I personally believe that Google, Facebook, Twitter, huge banks and corporations are definitely not communist. These corporations are certainly capitalist and conservatives will have to deal with that fact.

They didn’t get rich through communism. China didn’t get rich through communism. China and these huge corporations became wealthy through capitalism and now they’re perpetuating communist ideology.

Capitalism Inevitably Leads to Communism

I will make a more in-depth article regarding this in the near future.

I am going to play devil’s advocate for a second and quote Karl Marx on what he said in the communist manifesto. Marx postulated that the progress of society is attained by the rise and fall of some specific economic systems:

- Ancient slave systems

- Feudalism

- Capitalism

- Socialism

- Eventually communism

I personally believe we are in the transition phase between capitalism and socialism. I believe that capitalism indeed inevitably leads to socialism.

Before you come out and call me a communist, I am going to assure you that I definitely am not. I view all political and economic systems through a lens and also with a grain of salt, hence I criticize every economic system that runs contrary to my personal worldview.

“Crony” Capitalism is Still Capitalism

While I often hear of people talking about the differences between “crony” capitalism and “real” capitalism, these two seemingly different systems are both still capitalism.

If a state subsidizes a company unfairly, then that is still capitalism because that company has accumulated capital and has somehow incentivized the state to work in its favor.

The same people who argue against utopian communism somehow argues for utopian capitalism, a perfect system where every single corporation operates completely for the interest of others. This proposition is absolutely preposterous!

If you don’t believe in a 100 beneficent government then how on Earth can you, at the same time, hold the contradicting belief that all companies can somehow work in the favor of others?

There are also many people who hold the belief that the government yields a monopoly of power over the citizens of a country and that corporations do not share such powers. While this is in fact true, corporations can wiggle themselves into positions of power and effectively become by extension, a part of the government.

Most legislation passed through congress is already being written by lobbyists who work on behalf of huge Fortune 500 corporations. Capitalism, namely in the western world, already effectively controls the government.

As long as greed exists, all democratic governments will eventually pander to corporations. This is unavoidable unless you assume either the government or the corporations are “100% all good.”

Postmodern-Socialism

The goal of many corporations is to transition the world into a system of socialism. This socialist system, however, is not the typical socialist system you would find throughout the 20th century.

Instead, it is a system predicated on universal basic income and a consumerist culture that involves both: huge corporations providing subscription-based services and a gig economy of individuals creating content for other individuals to perpetually consume in order to perpetually grow the socialist economy.

Finite Economic Growth

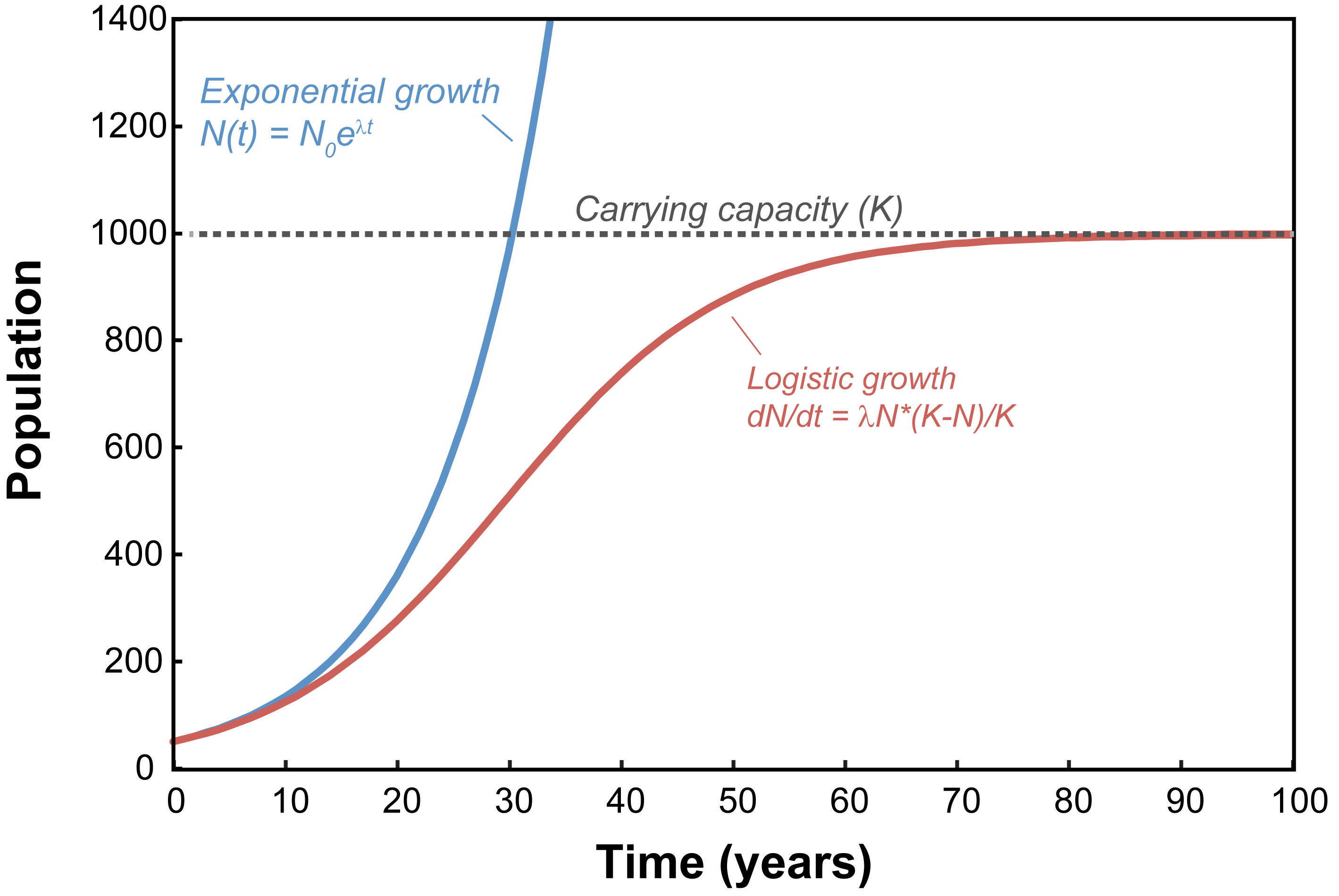

On the topic of perpetual growth, our current economic system is fundamentally predicated on the concept of perpetual (exponential) economic growth. The growth of different economies however, is modeled based on a logistics curve which begins slowly and the gradient increases to a point where which growth slows down due to limitations of either population, production, consumption or natural resources.

This gap is often referred to as an economic plateau and/or financial crisis. Environmentalists have capitalized on this reality to perpetuate green, sustainable eco-Marxist agendas.

It is not possible to decouple capitalism from endless growth because capitalism as an economic system is defined by perpetual growth. Since capitalism’s inception it has yielded a consistent growth rate of approximately three percent per annum, this growth rate is considered surplus. Financial analysts consider that zero or negative growth as a financial crisis and anything over three percent to be an “economic boom.”

Although three percent may initially seem like a minuscule figure, humans tend to underestimate the scale of compound growth. It’s often noted that three percent compound growth actually means that the economy will double approximately once every 25 years.

This means that by 2050, the world domestic product will go from approximately 70 trillion dollars to approximately 155 trillion dollars.

The Growth Imperative

We often talk about the relentless expansionary drive of modern corporations as somehow being out of greed alone. In reality, these companies and corporations and the CEOs who run them are themselves under an immense structural imperative to sustain perpetual growth. The only real way to generate enough surplus for

investor confidence is to generate more profit each year than the year prior.

This is precisely why publicly traded corporations have no individual or nationalistic imperative and why they’ll in any country’s favor in

return for investor confidence.

If a corporation does not return a profit margin it not only relinquishes some of its investor confidence, but it also loses value over time due to inflation. This only intensifies as the amount of capital the corporation accumulates increases.

Democratic Growth Imperative

This concept can be extrapolated to explain the democratic political paradigm. It is not possible for a political party to win elections by promising a lower standard of living. Instead, elections and democracies are effectively treated as auctions where political parties attempt to buy support with the promise of lower taxes, better social services and/or better standards of living fueled by growth.

Not only this, but the state must increasingly compete to attract multinational corporations to bolster their tax revenue and to employ workers – often foreign migrants.

If a government was to create an unattractive financial condition for large corporations, it would threaten the perpetual economic growth

and is ultimately enough to constrain government policy on the level of the nation states. This creates its own coercive law of competition in which states must for example, lower corporate tax rates or invest in infrastructure to bolster the attractiveness of those countries for multinational corporations.

There is no moral, traditional or cultural incentive to maximize economic growth, hence culture and traditions are seen as auxiliary aspects that is unnecessary to facilitate perpetual growth.

Capitalism as “State Sponsored Usury?”

Catholic literary professor E Michael Jones has often referred to capitalism as “state sponsored usury” and in justification of his

statement postulates that high interest loans itself is an imperative to perpetuate growth, since interest stimulates the economy in the short term.

Once extrapolated into the macroeconomic scale this bolsters the GDP of a nation state and hence incentivizes the government to reinvent policies more suited to a interest-based economy rather than a production and services based economy.

Many argue that money lenders make money in terms of interest, which is by definition risk. But it’s incredibly difficult to quantify

the concept of risk itself and hence it is also incredibly difficult to model the impacts of capitalizing based on risk.

In Conclusion

I believe that there’s no way to prevent socialism except for completely abolishing the institution of “capitalism”, as corporations by definition do not have the free-market’s interests at heart.

Corporations also works with governments by default to propagate

and instate laws that make it incredibly and increasingly difficult for small and medium-sized enterprises to compete with it in the free market.

The concept of capitalism itself facilitates anti-competitive behaviors and consumerist socialism.

Comments |0|

Tags: Capitalism, Communism, Marxism, Shareholders, Socialism